Stages Of Money Laundering Defined By The Proceeds Of Crime Act

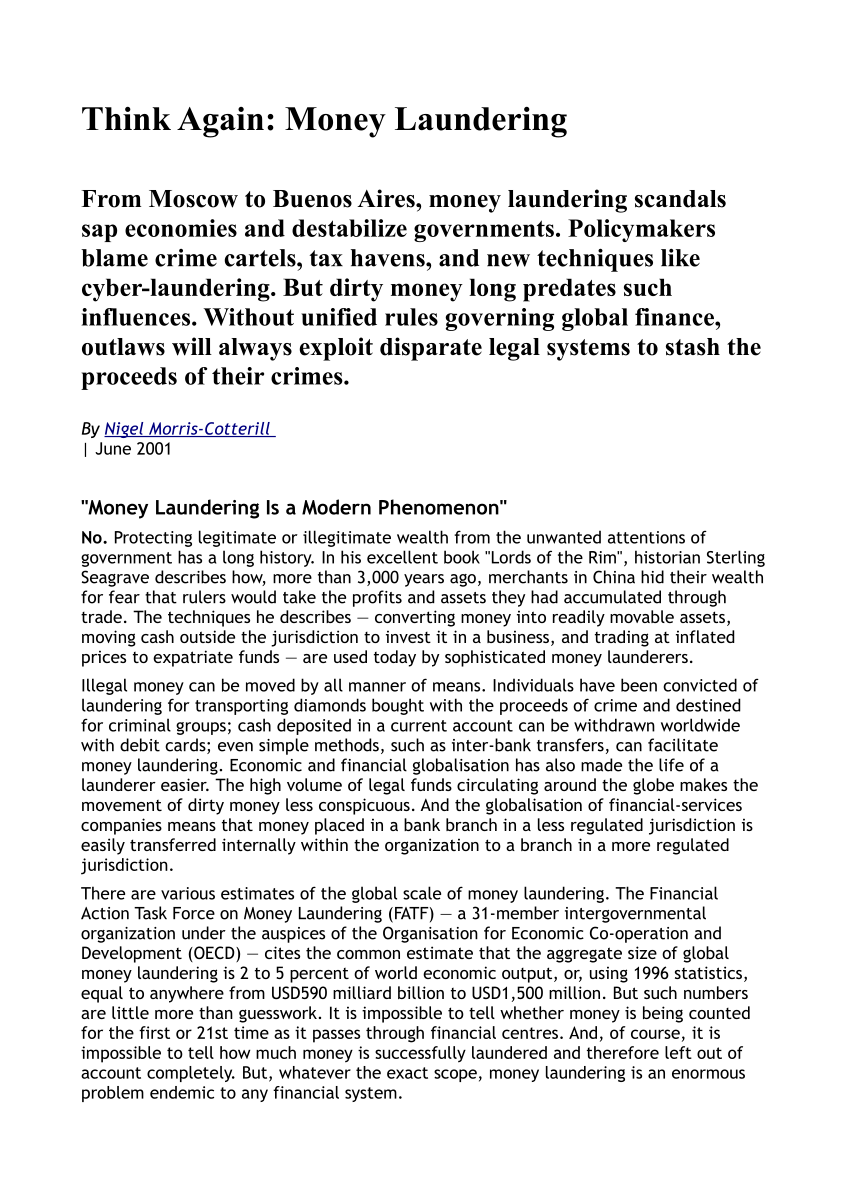

The idea of money laundering is very important to be understood for these working in the monetary sector. It's a course of by which soiled cash is transformed into clean money. The sources of the money in actual are felony and the cash is invested in a method that makes it appear like clear cash and conceal the id of the prison a part of the money earned.

Whereas executing the monetary transactions and establishing relationship with the new prospects or sustaining present prospects the obligation of adopting enough measures lie on each one who is a part of the organization. The identification of such factor at first is simple to cope with as an alternative realizing and encountering such conditions later on in the transaction stage. The central bank in any nation offers complete guides to AML and CFT to fight such activities. These polices when adopted and exercised by banks religiously present sufficient safety to the banks to discourage such situations.

This stage represents the initial entry of the dirty cash or proceeds of crime into the financial system. The goal of a large number of criminal acts is to generate a profit for the individual or group that carries out the act.

Pdf Introduction To Money Laundering Ghulam Alosh Academia Edu

Money laundering is the processing of these criminal proceeds to disguise their illegal origin.

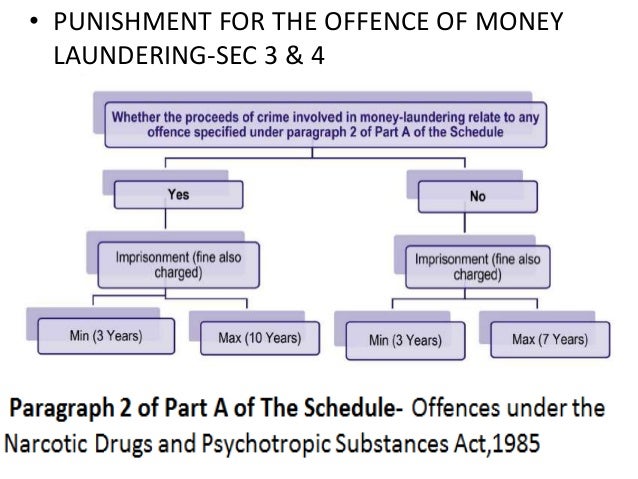

Stages of money laundering defined by the proceeds of crime act. The Proceeds of Crime Act POCA 2002 is a legislation that exists in the UK. The Prevention of Money Laundering Act 2002 levies a fine up to Rupees five lakhs. And b it places the money into the legitimate financial system.

THE PROCEEDS OF CRIME MONEY LAUNDERING PmvEwronj REG ULA TIQNS 2007 regulated business means a business falling within the regulated sector as defined in the Fousth Schedule to the Act. A it relieves the criminal of holding and guarding large amounts of bulky of cash. In this stage the criminal relieves himself of holding and guarding large amounts of bulky cash and the money is placed into the legitimate financial.

The Placement Stage Filtering. Relevant financial business means any financial business carried on by a regulated business. The other two are to be found in sections 328 and 329.

The maximum sentence for this offence is 14 years imprisonment on indictment or a fine or both and six months imprisonment or a fine or both summarily. The money laundering process is divided into 3 segments. What is the maximum penalty for money laundering under the Proceeds of Crime Act 2002.

This process is of critical importance as it enables the criminal to enjoy these profits without jeopardising their source. The principal money laundering offences created by the Proceeds of Crime Act 2002 are. POCA came into effect on 14 June 2000 after the release of the new government policy.

The principal money laundering offences in sections 327-329 of the Proceeds of Crime Act POCA are not committed where a person has made an authorised disclosure and obtained the appropriate consent to carry out the prohibited act. The concealing offence POCA 2002 s 327 the arranging offence POCA 2002 s 328 the acquisition use or possession offence POCA 2002 s 329. The first stage of money laundering is when the individual participating in criminal activity places cash proceeds into the financial system.

The placement stage represents the initial entry of the dirty cash or proceeds of crime into the financial system. Because of the definition of criminal property at section 340 all three principal money laundering offences now apply to the laundering of an offenders own proceeds of crime as well as those of someone else. Generally this stage serves two purposes.

Money laundering under the Proceeds of Crime Act 2002overview Money laundering under POCA 2002. The Bill expands the definition of offence under money laundering to include activities like concealment acquisition possession and use of proceeds of crime. The Bill proposes to remove this upper limit of fine.

The stages of money laundering include the. Recently ACAMS members Joseph Mari and Peter Warrack 8 have spoken and published on the four-stage model. It is during the placement stage that money launderers.

Money laundering under the Proceeds of Crime Act 2002overview Money laundering under POCA 2002. 14 yearsThe offence is triable either way. POCA deals with the process of recovering assets obtained illegally.

Predicate offense placement layering and integration. COFAs Toolkit 2nd edition. Traditionally money laundering is viewed as a three-stage model.

The concealing offence POCA 2002 s 327 the arranging offence POCA 2002 s 328 the acquisition use or possession offence POCA 2002 s 329. The principal money laundering offences created by the Proceeds of Crime Act 2002 are. This is done so that they can get.

Placement layering and integration. POCA aims to prevent and seize revenues from money laundering and terrorist financing activities carried out through institutions. Section 327 creates one of three principal money laundering offences.

1 Dymimic Estimation Of The Amount Of Money Laundering For 20 Highly Download Scientific Diagram

Anti Money Laundering And Counter Terrorism Financing

Guide To Money Laundering In The Year 2020 Money Laundering Financial Institutions The Year 2020

Money Laundering Awareness Objectives L Define Money Laundering

Anti Money Laundering And Counter Terrorism Financing

Anti Money Laundering And Counter Terrorism Financing

1 Dymimic Estimation Of The Amount Of Money Laundering For 20 Highly Download Scientific Diagram

Pdf Evaluating The Control Of Money Laundering And Its Underlying Offences The Search For Meaningful Data

Presentation On Money Laundering

Doc Basics Of Money Laundering Doc Abdinasir Ali Academia Edu

Understanding Money Laundering European Institute Of Management And Finance

Anti Money Laundering And Counter Terrorism Financing

The world of laws can seem like a bowl of alphabet soup at occasions. US money laundering laws are not any exception. We have now compiled an inventory of the top ten money laundering acronyms and their definitions. TMP Threat is consulting agency focused on protecting financial services by decreasing risk, fraud and losses. We've got massive financial institution experience in operational and regulatory risk. We have now a strong background in program management, regulatory and operational risk in addition to Lean Six Sigma and Business Course of Outsourcing.

Thus cash laundering brings many antagonistic consequences to the organization because of the risks it presents. It will increase the probability of main risks and the opportunity price of the financial institution and finally causes the bank to face losses.

Comments

Post a Comment